The long-term price of an asset carries the most information; financial advisors consistently tell investors to ignore short term fluctuations. Day-to-day changes in prices are less useful than the long-term trend and can depend on rumors, collective hallucination on social media, or a billionaire’s bet. More capital gains brackets, with high taxes on short-term, and low taxes on long-term gains would act to smooth out day-to-day noise in prices and focus investors on the long-term health and growth of companies.

In signal processing, a low-pass filter is one that passes low-frequency signals, and rejects (stops) high-frequency signals. For an example, think about the seven-day average of COVID-19 cases for specific areas; these averages filter out the day-to-day variation and reveal longer-term trends. In this case and in other signal processing applications, the low-frequency trends are informative, while the high-frequency changes are noisy. Capital markets need a low-pass filter.

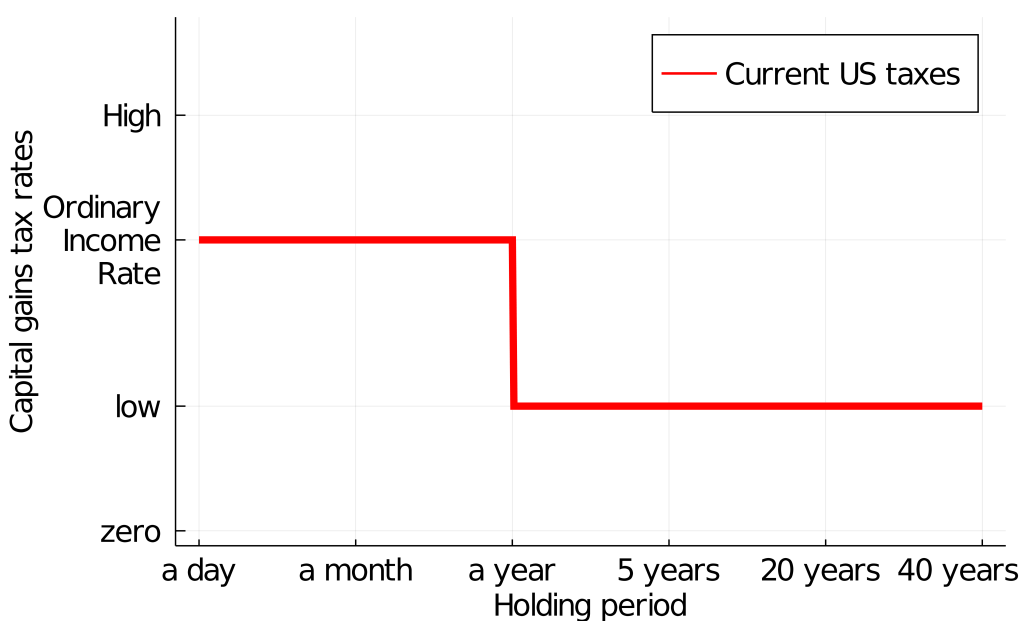

In the US we have a not-so-great filter in the form of normal income taxes on capital assets held less than a year, and lower taxes on assets held longer than a year. The red line in the figure above illustrates current US capital gains taxes. Investors are incentivized to hold their assets for at least a year, after which selling the asset will give them their lowest tax rate. Operators of high-frequency-trading bots who hold assets for only microseconds get the same rates as those who hold for 11 months, while those who hold assets for 13 months get the same tax rate as those who hold assets for 40 years. This seems wrong; my understanding is that long-term investments are much more likely to lead to jobs and allow technical innovation. Long-term investments would allow executives to focus on long-term growth.

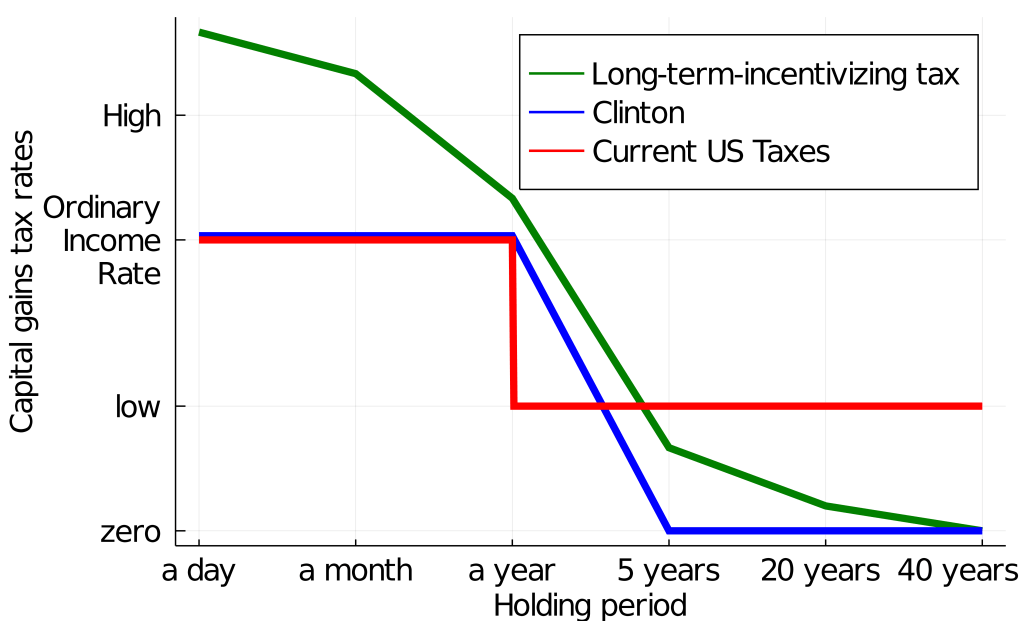

In 2015 Hillary Clinton proposed significant changes to the capital gains taxes. Even earlier, in 2012, conservative Clayton Christensen proposed something similar, suggesting that this would force more money into long-term investments and reduce the “billions in capital … sitting inert and uninvested.” The blue curve in the figure below represents these ideas, even if it does not capture the details from any proposal. I like these proposals, yet I think we can do more.

An even better idea is to increase capital gains taxes on assets held for less than a year as illustrated with the green curve, and add more long-term brackets. I am assuming in my discussion that the tax change would be revenue-neutral; someone smarter than me would have to determine the right values for the taxes so that we don’t end up raising more or less revenue than at present.

What would happen with the proposed long-term incentivizing tax? One result is less trades would happen; isn’t this obviously a bad thing? No, Hal Varian has said he thinks there are too many trades. There would be less liquidity in the markets, yet Steve Waldman has noted that “Liquidity isn’t apple pie“. He also suggests that lowering the number of noise (short-term) trades would lower costs for long-term trades. I believe the long-term-incentivizing tax would result in much less day-to-day or week-to-week variation in the prices of assets; the tax would act as a low-pass filter on markets. The main impact of the tax change would be much more of a focus on the long-term health and growth of companies.

I don’t pretend to have given a detailed proposal; for example it may be that having many capital gains brackets is appropriate only for people with incomes over (say) $150k/year. I also don’t pretend that what I suggest is new, or even that my post will have any but the tiniest of impacts on the world. Even so, when I find a public policy that I like such as this (or a more progressive income tax) I like to note it and share it with a few family and friends. Please let me know if you find politicians working on such tax policy; I’m willing to donate.