I support Ukraine during the current war; though they are receiving significant foreign aid, revenue from income tax remains a big part of their national budget. This post reviews individual income tax in Ukraine for everyday people and for a class of entrepreneur. I show effective tax rates vs income for these two classes and for US taxpayers. While US income taxes are progressive, Ukrainian taxes are flat or even regressive when social security taxes are included.

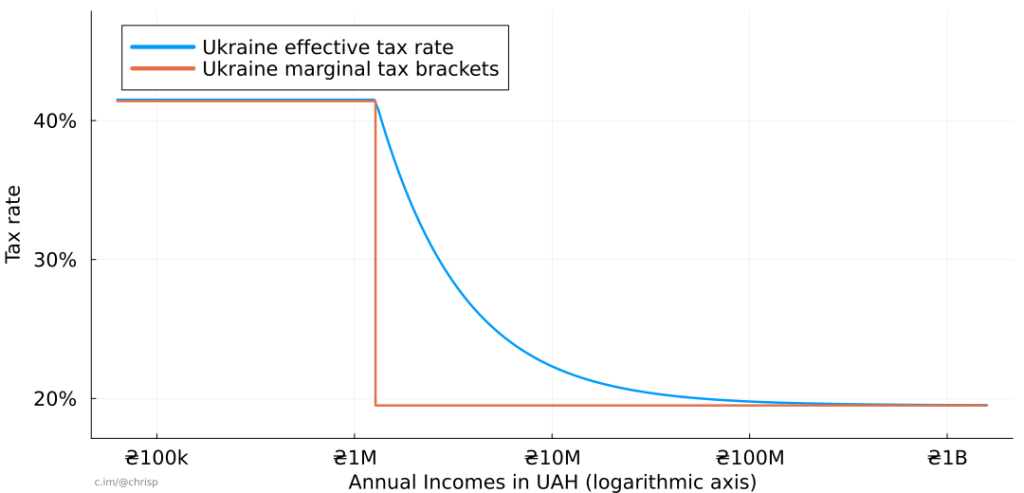

Basic Ukrainian income tax is nominally flat at 18% on all income for residents and non-residents. Employees also pay a 1.5% military tax (which will be raised to 5% in 2025), while employers pay an additional social security tax of 22% on the first 1,440,000 Ukrainian hryvna (denoted by ₴ or UAH in what follows) of income each year for each employee. The figure below shows in red that the marginal tax rate is 41.5% (18% + 1.5% + 22%) below ₴1,440,000, and is 19.5% above that threshold, while the blue curve gives the effective (average) tax rate; in what follows we will focus on effective tax rates. Note that the horizontal axis is annual income shown on a logarithmic scale.

Why are we combining the employer-paid tax of 22% with the employee-paid tax of 19.5%? Even though the employee will hopefully get a specific retirement benefit from the Ukrainian government for such contributions, these contributions and benefits are not (to my knowledge) directly owned by the employee, and future laws could change the benefits provided. It also makes sense for an employer to look at what percent of their total payments (taxes + salary) for an employee actually end up in the employee’s pockets.

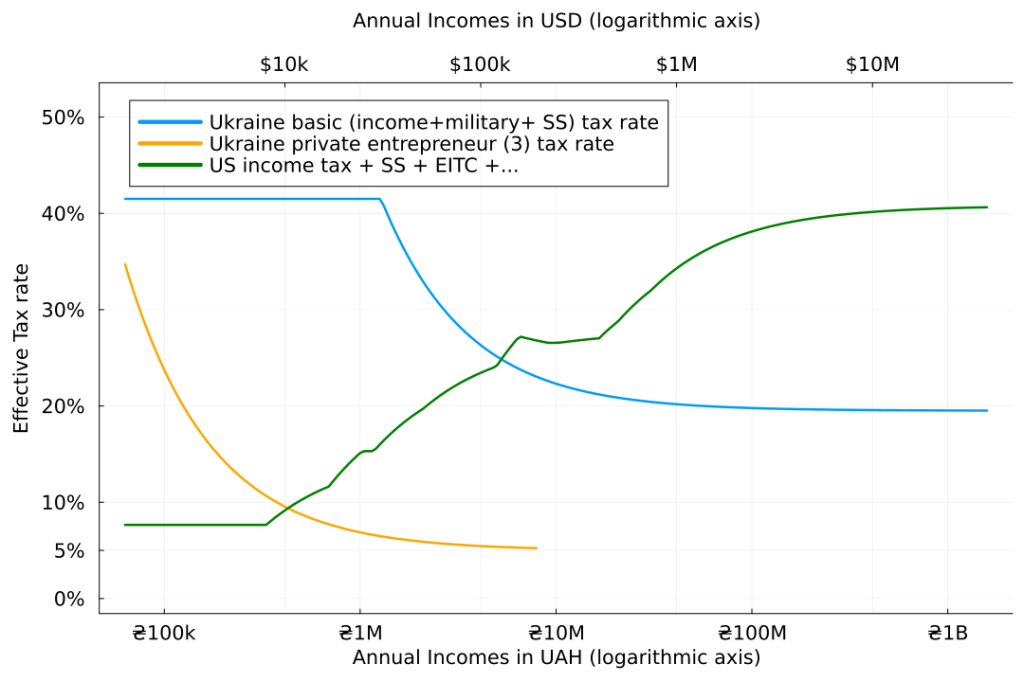

The next figure shows the same basic effective tax rate in blue, the Ukrainian effective tax rate for a class of entrepreneurs in orange, and (for comparison) the effective US income tax including FICA (social security and Medicare) and other taxes as calculated via Taxsim. While the Ukrainian tax brackets and numbers are for 2024, the US income tax is for 2023, since Taxsim does not yet have data for 2024. The US data are shown on the same plot assuming a conversion rate of $1= ₴41.28.

The “private entrepreneur 3, non-VAT” tax classification, for which the effective tax is shown in orange, is often used by IT professionals in Ukraine. For example, an international software company might have an entire division of “private entrepreneurs” working for it in Ukraine. These people will work in an office, have office parties, have an HR person to work with them, and function in many ways like ordinary employees, but for tax purposes will be contractors and will pay a much lower tax than other Ukrainians making the same wages. People in the specific entrepreneur tax class shown in orange pay a base tax of 5% of their income, and prior to the war also paid a minimum of a social security tax of 22% of the basic income (not 22% of their full wage as in the basic tax classification). The social security tax is optional during the war for these entrepreneurs (but not for ordinary taxpayers). This tax classification is limited to people earning less than ₴8,285,700 (about $200,000) per year. Recent legislation may change how these entrepreneurs are taxed in 2025, though the details are not yet clear.

There are many ways the figures above could be improved (if you see a mistake, please let me know). There are other tax classifications in Ukraine, and other details were omitted. Even so, I believe that the two individual income tax classifications shown above are enough to give a flavor of Ukrainian income taxes.

US individual taxes are progressive; low income people pay a low rate, while high income people pay a higher rate; this is the case whether one does or does not include social security taxes. Ukrainian income taxes are very different: with social security payments Ukrainian income taxes are regressive, without they are flat. I like the tax structure of the US much more than that of Ukraine: the US’s progressive taxes act to lower economic inequality, build a middle class, and stabilize society.

Dec 4 Update: In follow-up research I learned that the IMF has asked Ukraine to consider an individual income tax that is progressive. As another good sign, Ukraine’s National Revenue Strategy for 2024–2030 includes discussion of a progressive income tax. Finally, the current flat tax was implemented in 2004; before that it was progressive.