How could we achieve a stable income distribution? With a progressive income tax.

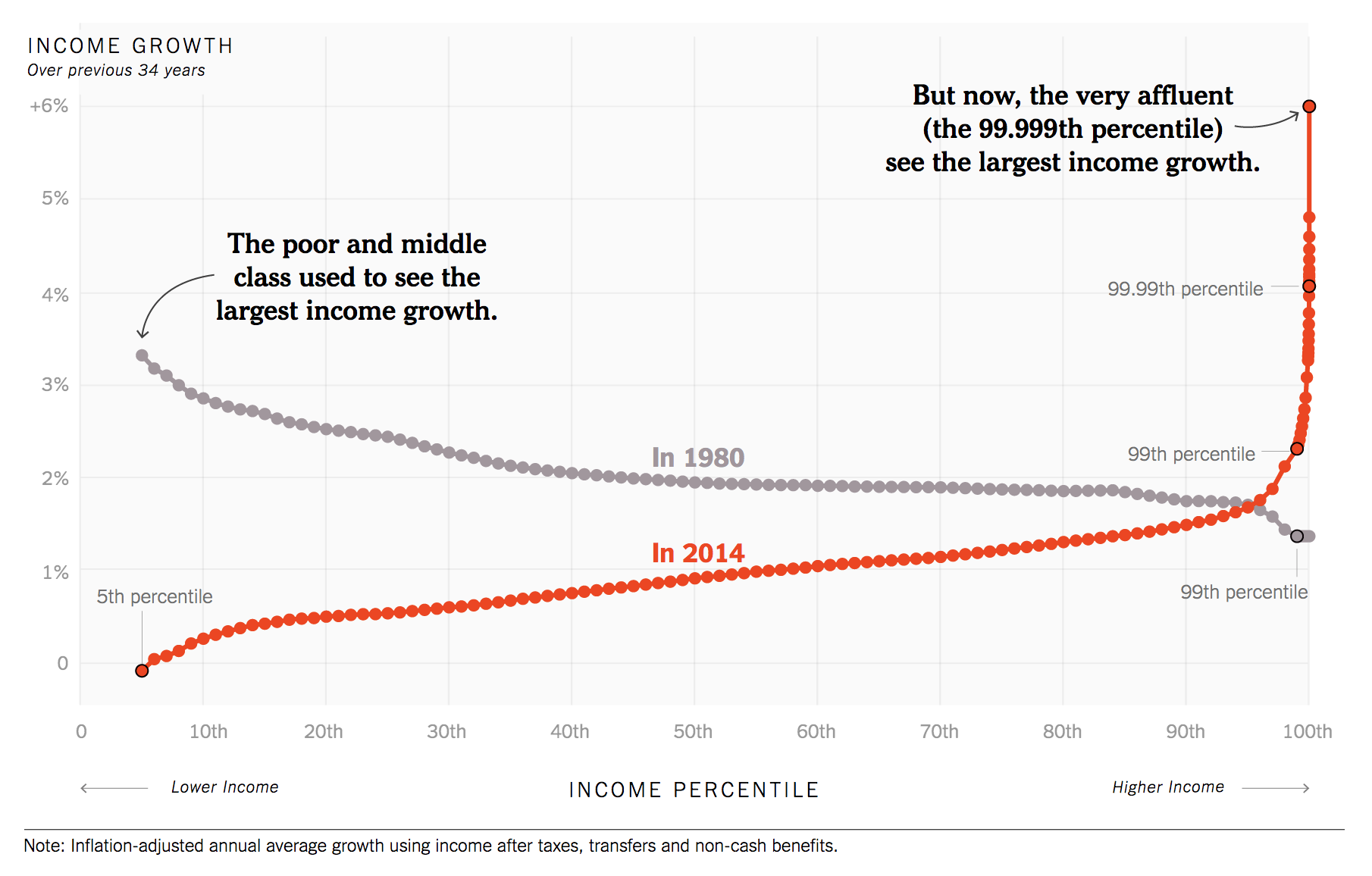

In the US, the rich are getting richer, while the income of the lowest income brackets are staying the same. The number of the rich and the poor are increasing; the distribution is not stable and we are moving more and more towards a two-class system, with a rich class, a poor class, and a shrinking middle class in between.

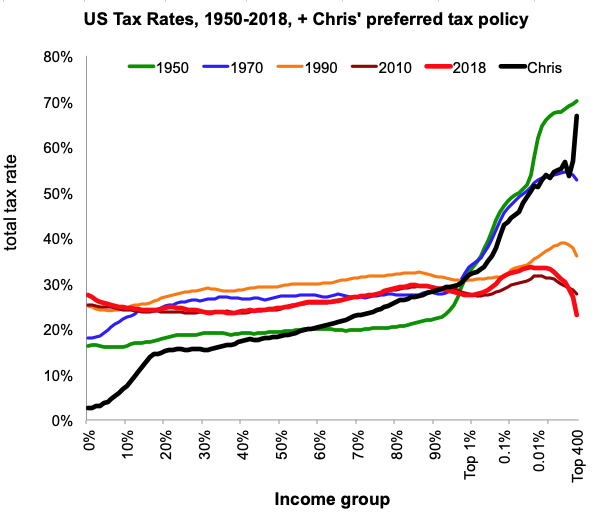

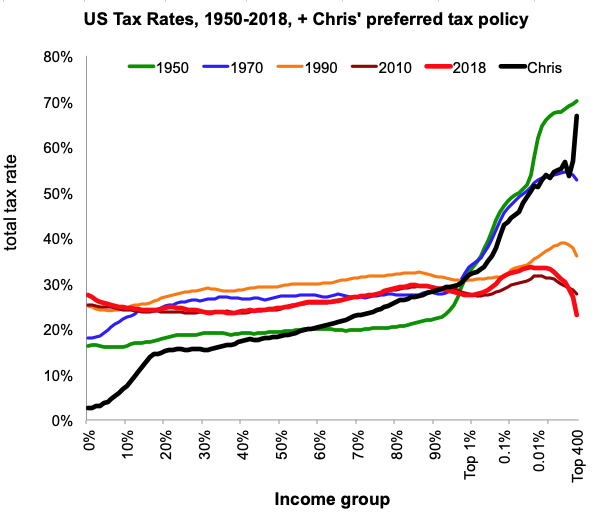

The obvious question is, why? What is the reason for this dramatic change in the distribution of the money being made in the US? I believe the main reason for the change is the dramatic change in the income tax rates between 1970 and 2020 as illustrated in the figure below (data from Zucman). In 1950, the US taxed the lowest income bracket a full 10% less than now, and taxed the highest income brackets much more, up to 70%. As a reminder, the 1950s were a time of strong economic growth; I think the tax structure was a critical part of that growth. Low taxes for low income people encouraged them to work more, while higher taxes on higher incomes could fund social programs and indicated that we preferred an additional dollar made by a lower income worker to an additional dollar made by a millionaire.

These are total tax rates (income, capital gains, payroll taxes, wealth tax, etc…); the most dominant tax for the middle class is the income tax, for which a similar figure can be made (see 1970 and 2010 data for example). Comparing this figure with the income growth figure from the previous post, it is clear (to me at least!) that the main reason for the rising income inequality is higher taxes on low-income earners, and dramatic lowering of income and other taxes on the wealthy. The figure above also shows what sort of taxes I’d like to see. I would like even lower taxes for the lowest income people (to encourage them to work), and about 1970s-level taxes on the wealthy. I’m not married to these exact values; if I knew how to make this curve revenue-neutral, I would.

Why impose such high rates on the wealthy, especially the ultra-wealthy? In combination with the lower rates for low-income people, a more progressive tax system such as I show in the figure says that we value an additional $10,000 made by each of 100,000 people more than an additional $1 billion made by a billionaire (note that $10,000 times 100,000 = $1 billion). This tax system would encourage the lowest income people to work more, and to move into the middle class; it would also have the effect to move some of the riches down into the middle class as well. It would reverse the tendency of our current system to shrink the middle class, and move everyone into either wealthy or low-income groups. There are other reasons to have this progressive tax system (income effects inducing higher cumulative happiness, other moral arguments); I’d prefer to start with the direct effects discussed above.

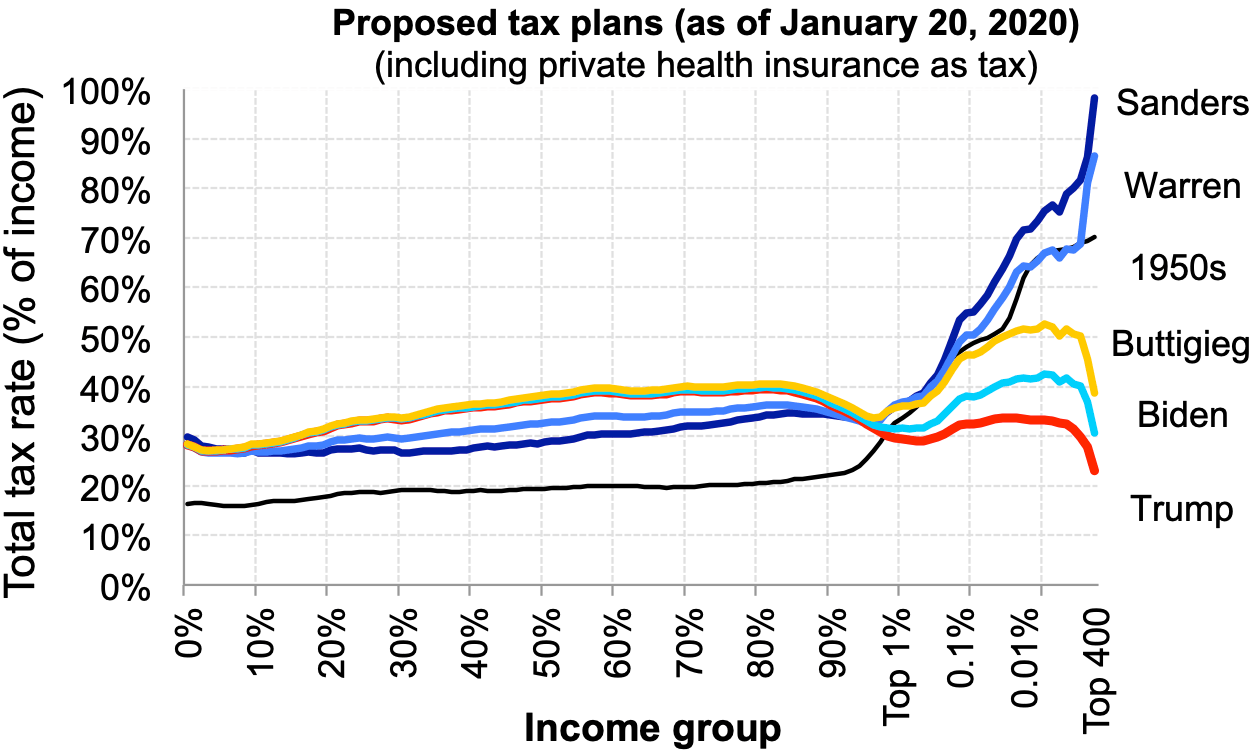

Elizabeth Warren and other 2020 Democratic candidates for the president have proposed that we make the tax system more progressive. I support these efforts to make a stable income distribution.

Of course I’m not an expert; other sources will have much more information. I wrote this to (if nothing else) show to family and friends that I think the tax structure is an important policy topic, and to indicate what I believe our tax structure should be.

Please talk to me the next time we meet about this!

Update: The wobbles in my effective tax in the figure above between the top 0.01% and the top 400 are an artifact of the spreadsheet from Zucman that I used to generate the figure and are not something I actually recommend 🙂